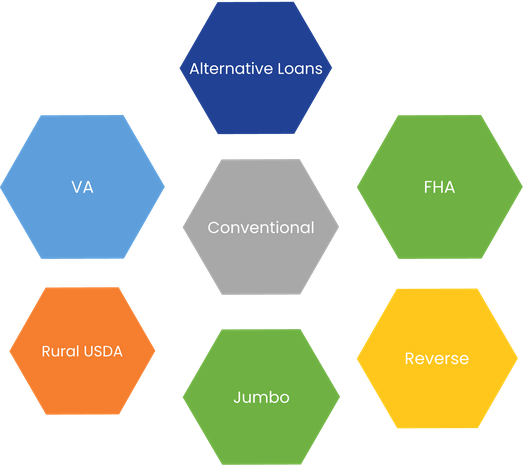

Conventional Loan

One of the advantages of a conventional loan is that the borrower can avoid paying the upfront mortgage insurance and possibly the monthly mortgage insurance of an FHA loan. Conventional products like HomeReady and HomePossible allow for certain eligible borrowers to take advantage of lower down payments and mortgage insurance rates. The HomeStyle loan permits homebuyers to finance additional funds into their mortgage to improve or upgrade their home without paying an upfront mortgage insurance premium. With this product, homebuyers can quickly and easily tap into cash to pay for property repairs or improvements, such as those identified by a home inspector or appraiser. The construction loan allows borrowers to build their dream from the ground up.

FHA Loan

An FHA loan is insured by the Federal Housing Administration, a federal agency within the U.S. Department of Housing and Urban Development (HUD). The FHA does not loan money to borrowers, rather, it provides lenders protection through mortgage insurance in case the borrower defaults on his or her loan obligations. Available to all buyers, FHA loan programs are designed to help those with bruised credit and/or low- to moderate-income families who do not meet the requirements for conventional loans. FHA's 203(k) program permits homebuyers to finance additional funds into their mortgage to improve or upgrade their home. With this new product, homebuyers can quickly and easily tap into cash to pay for property repairs or improvements, such as those identified by a home inspector or FHA appraiser.

VA Loan

VA guaranteed loans are guaranteed by the U.S. Department of Veteran Affairs (VA) to eligible veterans for the purchase of a home. The guaranty means the lender is protected against loss if you fail to repay the loan. In most cases, no down payment is required on a VA-guaranteed loan, and the borrower usually receives a lower interest rate than is ordinarily available with other loans.

Rural Development

Rural Development, a division of the US Department of Agriculture, helps home buyers throughout the state realize the American dream of home ownership. This program, administered through the US Department of Agriculture, features 102% financing for qualified moderate-income families looking to purchase single-family homes. For borrowers with little or no cash, it's ideal since no down payment and no funds are needed for closing.

Jumbo Loan

A jumbo mortgage is a form of home financing whose amount exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). As a result, unlike conventional mortgages, it is not eligible to be purchased, guaranteed, or securitized by Fannie Mae or Freddie Mac. Designed to finance luxury properties and homes in highly competitive local real estate markets, jumbo mortgages come with unique underwriting requirements.

Reverse Mortgage

Reverse mortgages (also called home equity conversion loans) enable elderly homeowners to tap into their equity without selling their home. The lender pays you money based on the equity you've accrued in your home; you receive a lump sum, a monthly payment, or a line of credit. Repayment is not necessary until the borrower sells the property, moves into a retirement community, or passes away. When you sell your home or no longer use it as your primary residence, you or your estate must repay the cash you received from the reverse mortgage plus interest and other finance charges to the lender.

Alternative Lending

Our Bank Statement program and 1099 program provides a loan solution to help underserved credit-worthy self-employed borrowers who otherwise would not qualify for a home loan. The DSCR Investor Cash Flow mortgage program allows borrowers to qualify based on rental analysis to determine property cash flow. A home equity line of credit (HELOC) can help homeowners tap into the equity of their home up to 89.99% of the current value of their home.